Noticias del sector inmobiliario y actualidad de VAPF

Descubre las últimas noticias inmobiliarias, actualizaciones y tendencias sobre el mercado de lujo y el estilo de vida en la Costa Blanca.

Explora nuestras noticias y mantente al día sobre la actualidad inmobiliaria y novedades VAPF.

Todas las noticias

Summer Party 2025 Cumbre del Sol

01.07.2025

Summer Party 2025 Cumbre del Sol el 10 de Julio 2025.

Leer noticia

Nuevos puntos de recarga coches eléctricos CDS

26.06.2025

Nuevos puntos de recarga de coche eléctrico en Cumbre del Sol, un paso más hacia un residencial más sostenible.

Leer noticia

¿Qué ventajas tiene vivir en Cumbre del Sol?

12.06.2025

Vivir en Cumbre del Sol es disfrutar de naturaleza, mar, servicios premium y clima excepcional.

Leer noticia

Lo que opinan nuestros clientes

10.06.2025

Clientes VAPF comparten su experiencia: calidad, confianza y vida junto al Mediterráneo.

Leer noticia

Top 5 Villas con Vistas Únicas de Grupo VAPF

03.06.2025

Top 5 villas de lujo con vistas espectaculares en Cumbre del Sol, Altea y Calpe.

Leer noticia

Banderas Azules 2025: Excelencia y sostenibilidad en las playas de la Marina Alta

26.05.2025

Descubre las playas con Bandera Azul 2025 en los municipios donde VAPF construye tu nuevo hogar.

Leer noticia

Villa Indigo en Cumbre del Sol: lujo contemporáneo con vistas al mar, lista para entrar a vivir

22.05.2025

Villa Indigo en Cumbre del Sol: diseño, vistas al mar y lista para entrar a vivir. ¡Pura inspiración!

Leer noticia

¡Únete al campamento en inglés de Lady Elizabeth School en Cumbre del Sol este verano!

20.05.2025

Nuestro Campamento de Verano es el lugar ideal donde la diversión y el aprendizaje van de la mano. Aprende inglés o español mientras disfrutas de una experiencia inolvidable.

Leer noticia

Grupo VAPF - Mucho más que una promotora constructora en la Costa Blanca Norte

06.05.2025

Elige el promotor adecuado para construir tu nuevo hogar en la Costa Blanca Norte, Grupo VAPF más que un promotor.

Leer noticia

Allure Smart Apartments en Calpe

30.04.2025

Allure Calpe: Smart Apartments con domótica, eficiencia energética y seguridad avanzada en la Costa Blanca.

Leer noticia

¿Buscas tu hogar ideal? 5 claves para encontrar tu hogar ideal

24.04.2025

Encuentra tu hogar ideal con estos 5 consejos clave sobre ubicación, distribución, calidad y más.

Leer noticia

Lady Elizabeth School en Cumbre del Sol: Reconocido entre los Mejores Colegios de España en 2025

22.04.2025

Lady Elizabeth School ha sido nuevamente reconocido en los rankings más prestigiosos a nivel nacional.

Leer noticia

Nueva VAPF Store en Calpe

17.04.2025

Le esperamos en nuestra nueva oficina de ventas en Calpe, en Allure- Luxury Urban Resort.

Leer noticia

Torre B de Allure en Calpe: Nuevo lanzamiento tras el éxito de la Torre A

09.04.2025

Torre B de Allure en Calpe ya a la venta. Vive en un exclusivo apartamento de lujo con vistas al mar, impresionantes zonas comunes de más de 3.500m2, con varias piscinas.

Leer noticia

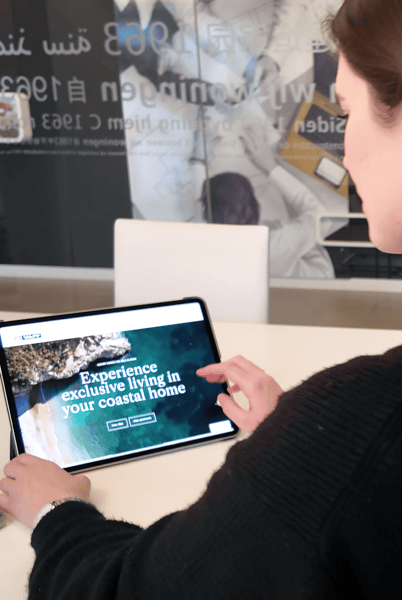

VAPF estrena nueva página web: una experiencia digital renovada

13.02.2025

Nuestra nueva web ha sido desarrollada con el objetivo de mejorar la usabilidad, facilitar el acceso a la información más relevante sobre nuestros proyectos e incrementar la calidad de imagen y video para que los usuarios puedan ver las villas y apartamentos de lujo como si estuviesen en la Costa Blanca Norte.

Leer noticia